Do you know the new 2025 obligations for manufacturers, importers or distributors of single-use plastic packaging in Spain?

The plastic tax (0.45 euros per kilogram of non-recycled plastic) has been announced for years. This obligation came into force from January 1, 2023 and caused a damage to the pocket for those companies where the production with virgin plastic was predominant, but did not require a minimum recycling, a situation that changes for 2025…

What are the minimum percentages I am required to certify?

This new obligation has caught by surprise not only many Spanish companies, but also foreign companies that import their products to Spain.

And indeed, if you are in the sector, you should already know that since January 1, 2025 it is mandatory to manufacture with a minimum average of 20% recycled plastic, except for PET where a minimum average of 25% is imposed.

But this does not end here, since by 2030 this percentage rises to 30% recycled in all packaging according to Royal Decree 1055/2022.

How can I avoid paying part of the tax?

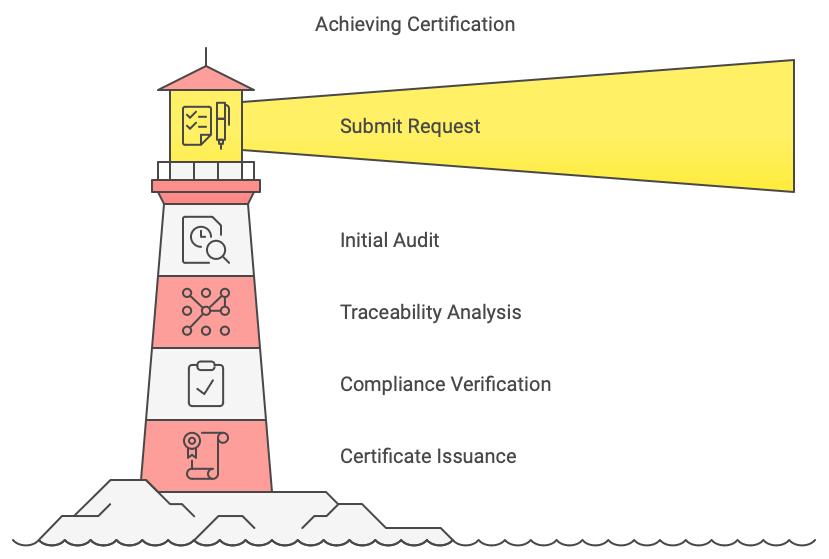

This minimum recycled content must be certified in your company through the UNE-EN 15343 standard, by an entity accredited by ENAC as EXTERNA. Once certified, the information contained in the invoice must be truthful and maintain traceability with what is stated in the certificate by the Certification Body.

How do I make sure I am not committing fraud?

The denomination of the certified product must be traceable to the identification contained in the UNE EN 15343 certificate, since in case there is an error in the sales data of certified products, Law 7/2022 establishes a fixed fine of 75 euros for each incorrect invoice or certificate.

For example: If your organization has sales of 15,000 invoices per year, and in all of them, there was this error, the amount of the fine would total 1,125,000 €.

When do I have to pay the tax depending on my activity?

As a manufacturer, when the product is first delivered to the buyer or made available to the buyer in the territory where the tax applies (in this case in Spain).

As an importer of the product, the tax will be applied when the products formally enter the country, i.e. at the same time the import duties are paid.

In case of intra-community acquisitions, the tax payment will be made on the 15th day of the following month, except if the supplier issues the invoice of the operation, then the tax is due on the date of the invoice.

And now… where do I start?

We know it’s not easy to keep up to date with all the regulations in this area, so if you need help and don’t know where to start, contact us.

We are experts, take your worries away 😉